Medicare/Medicaid

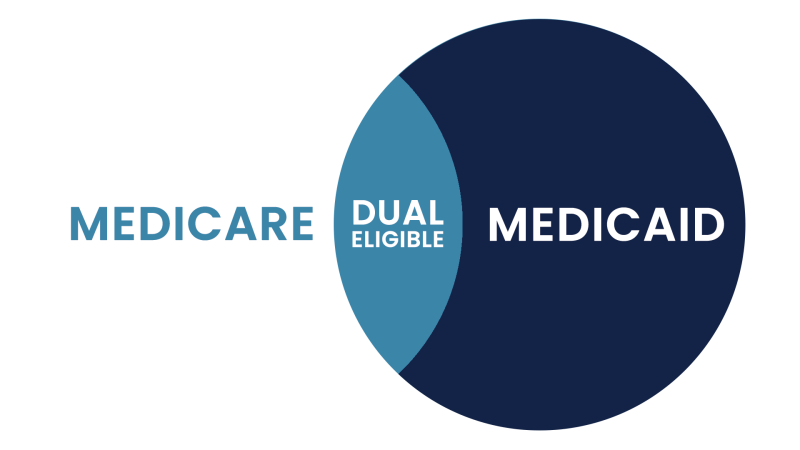

Dual Eligibility

We research all the plans available to those who are eligible for both Medicare and Medicaid. We want to make sure you are receiving all the benefits available to you. Clients have been able to add benefits such as:

Over-The-Counter

Cards that help pay for over-the-counter items such as cold medicine or vitamins. These cards typically have an allowance that is replenished monthly.

Healthy Food

Cards that help pay for healthy foods. These cards are typically replenished monthly.

Silver Sneakers

Helps pay for gym memberships.

Other Benefits

Other benefits include transportation services, chiropractic care, dental, and vision to name a few.

*Dual eligible beneficiaries are able to change their plans quarterly, not just during the open enrollment period. You could start receiving these additional benefits as early as the 1st of next month!

Differentiating Medicare and Medicaid.

Medicare is a federal health insurance program for seniors and disabled persons and has no financial restrictions. Medicaid is a state and federal medical assistance program for lower income individuals and families.

Call today to set up a free, confidential consultation 518.528.1550 or email me

Dual Eligible

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance). As an alternative to Original Medicare (Part A and Part B), persons may opt for Medicare Part C (Medicare Advantage). While Original Medicare is managed by the federal government, Medicare Advantage plans are managed by Medicare approved private insurance companies. Via Medicare Advantage, program participants receive Medicare Part A, Part B, and often Part D (prescription drug coverage).

Benefits of Dual Eligibility.

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid also covers some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care. (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, helps to cover the costs of Medicare premiums, deductibles, and co-payments.

-

Adult Day Care / Adult Day Health

-

Personal Care Assistance (at home, adult foster care homes, and assisted living facilities)

-

Medical / Non-Medical Transportation

-

Respite Care (to give the primary caregiver a break)

-

Congregate Meals / Meal Delivery

-

Home Health Aide / Skilled Nursing

-

Home Modifications (widening of doorways, installation of ramps, addition of pedestal sinks to allow wheelchair access, etc.)

-

Personal Emergency Response Systems

-

Housekeeping / Chore Services

-

Companion Services

-

Transition Services (from nursing home back to home)

-

Therapies (physical, occupational, and speech)

-

Medication Administration

Both Medicaid and Medicare will provide Durable Medical Equipment, such as wheelchairs and walkers.

Eligibility Requirements

-

Medicaid

Medicaid has income and asset limits. Generally speaking, in 2022, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,523 / month, and the asset limit is $2,000. There is some variation of income and asset limits by state. See Medicaid eligibility requirements by state. Applicants must also have a functional need for care, which generally equates to a level of care consistent to that which is provided in a nursing home. Learn more.

-

Medicare Savings Programs

The income and asset requirements for Medicare Savings Programs do not use the above financial criteria. There are three MSP programs that are relevant to the elderly. In 2022, most states use the limits below, but some states use different guidelines. For example, Alaska, Connecticut, the District of Columbia (DC), Indiana, Maine, Massachusetts, and Hawaii have higher income limits, and some states, such as Alabama, Arizona, Connecticut, Delaware, DC, Louisiana, Mississippi, New York, Oregon, and Vermont do not limit one’s assets.

-

Qualified Medicare Beneficiary (QMB)

The QMB program helps to pay the monthly premiums for Medicare Part A and Part B, share of costs, coinsurance, and deductibles. The income limit is 100% of the Federal Poverty Level (FPL), plus a $20 disregard. A single applicant can have income up to $1,153 / month and a couple can have up to $1,546 / month. The asset limits are higher than they are for full Medicaid. The limit for a single applicant is $8,400, and the limit for a couple is $12,600.

-

Specified Low Income Medicare Beneficiary (SLMB)

The SLMB program helps pay the premium for Medicare Part B. The income limit is 120% of the FPL, plus an additional $20 that is disregarded. An individual can have monthly income up to $1,379 and a couple can have up to $1,851. The asset limit is $8,400 for an individual and is $12,600 for a couple.

-

Qualifying Individual (QI)

The QI program, also called Qualified Individual, helps pay the monthly premium for Medicare Part B. The income limit is 135% of the FPL, plus a $20 disregard. A single applicant can have income up to $1,549 / month, and couples, up to $2,080 / month. Assets are capped at $8,400 for an individual and $12,600 for a couple.

Meet with Sean

You deserve to understand all of your Medicare options.

I have a local office in Saratoga Springs, but I am always willing to find a way to help clients wherever they reside.

Location

125 High Rock Ave. Suite 215

Saratoga Springs, NY 12866

Contact

(518) 528-1550

There is no fee to meet with Sean.

After you send your request, Sean will reach out to you to set up an appointment.